sanford maine excise tax calculator

Please note this is only for estimation. The amount of tax is determined by two things.

Free Maine Payroll Calculator 2022 Me Tax Rates Onpay

A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a.

. For example if the final window sticker of my new vehicle was 2000000 and I paid 500 for destination charges then this would be the calculation. There is no applicable county tax city tax or special tax. The 55 sales tax rate in Sanford consists of 55 Maine state sales tax.

We administer the real estate transfer tax commercial forestry excise tax controlling interest transfer tax and telecommunications business equipment tax and we determine annually the. The excise tax you pay goes to the construction and. The amounts shown are.

Sanford Colorados Sales Tax Rate is 29. Sanford collects the maximum legal local sales tax. 207 324 9115 Phone 207 324 9122 Fax The Town of Sanford Tax Assessors Office is located.

How 2021 Sales taxes are calculated in Maine. The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehicle. Maines Office of the Revisor of Statues explains that youll pay 5 per year in excise tax if you own a motor vehicle.

Maine Land for Sale. Sanford Maine 04073. The MSRP is the Manufacturers Suggested Retail Price of your vehicle.

Collects excise taxes for motor vehicles and recreational vehicles as well as registering those items for. The interactive calculator below allows property tax payers to enter the amount of their annual bill to learn how those dollars are allocated to various Town expenses. The 55 sales tax rate in saco consists of 55 maine state sales tax.

3 hours ago The excise tax due will be 61080. - NO COMMA For new vehicles this will. Manufacturers suggested retail price MSRP How is the excise tax calculated.

While many other states allow counties and other localities to collect a local option sales tax Maine does not. Fees Fee includes 100 agent fee 0-10 Horsepower Motor - 3100 with lake and river protection sticker. How much is the excise tax.

Enter your vehicle cost. The age of the vehicle. Online calculators are available but those wanting to figure their excise tax in Maine can do so easily using a manual calculator or paper and pen.

Assessor of Taxes - TOWN OF WARREN The state general sales tax rate of Maine is 55. Motor Vehicle Excise Tax Finance Department. The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehicle.

To calculate your estimated registration renewal cost you will need the following information. Sanford City Taxes are always due as follows and mailed in mid-August. Town of Sanford Assessors Office.

This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. 0-10 Horsepower Motor - 1600 without lake and river protection sticker. State has no general sales tax.

The Sanford Maine sales tax is 550 the same as the Maine state sales tax. Please note this is only for estimation purposes -- the exact cost. - First Installment due September 15th Only exception is if this date falls on a weekend - Second Installment due.

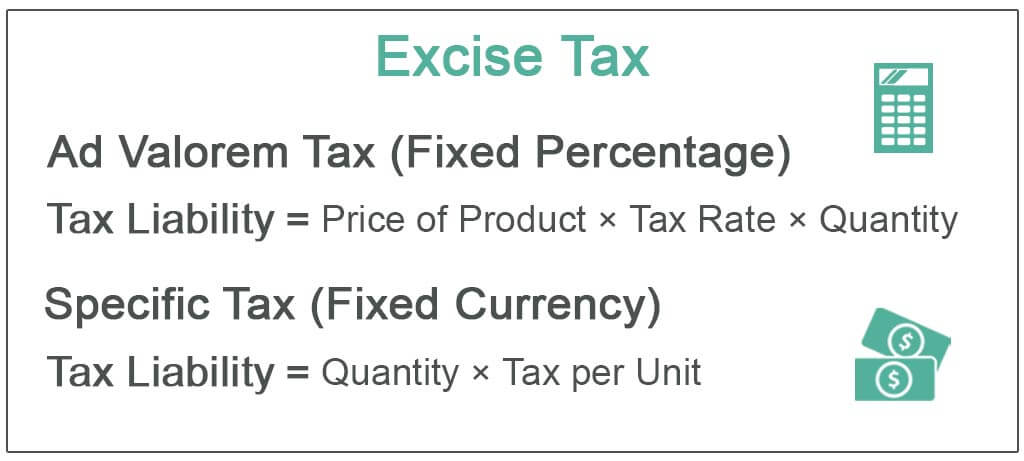

Excise Tax What It Is How It S Calculated

Maine Auto Excise Tax Repeal Question 2 2009 Ballotpedia

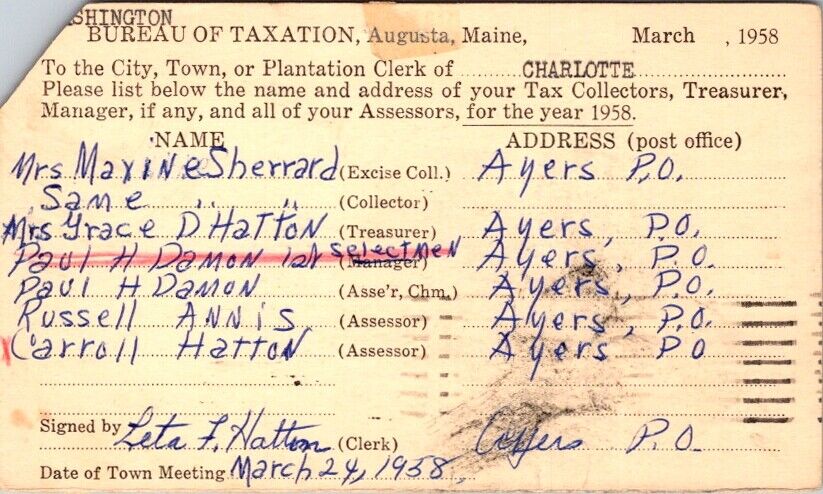

Postal Card State Of Maine Bureau Of Taxation To Charlotte Maine Me 1958 S348 Ebay

Excise Tax Definition Types Calculation Examples

Excise Tax Estimator City Of Ellsworth Maine

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How To Figure Your Excise Taxes In Maine Sapling

Maine Property Tax Calculator Smartasset

Welcome To The City Of Bangor Maine Excise Tax Calculator

Maine Sales Tax Calculator And Local Rates 2021 Wise

Motor Vehicle Registration The City Of Brewer Maine

Maine Car Registration A Helpful Illustrative Guide

Maine 2022 Sales Tax Calculator Rate Lookup Tool Avalara

I Team Maine Excise Tax Among The Highest In Us How Is That Money Spent Wgme

Ws July 3 2020 By Weekly Sentinel Issuu